Connell Company|Connell Hospitality|Connell Finance|Connell Equipment Leasing

Inflation Protection

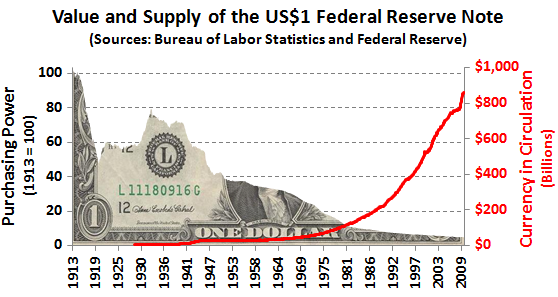

“By a continuing process of inflation, government can confiscate secretly and unobserved, an important part of wealth of their citizen .” -- John Maynard Keynes

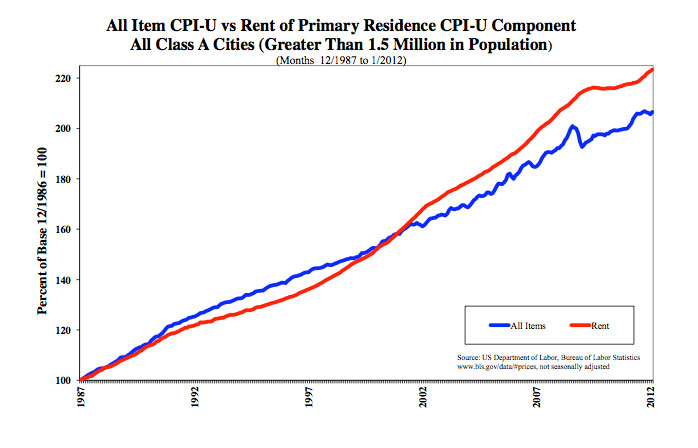

Connell’s historical strategy has been to acquire assets whose values will have the greatest potential for synchronicity with inflation’s long term trend. Building on the decades of successful ownership and management of inflation-protected earning assets for itself and its partners, Connell believes multifamily housing rent has a high correlation with core inflation; therefore owning properties in this sector represents one of the most effective hedges against inflation available to the market. As demonstrated by the chart below, residential rents have shown a high correlation to consumer price inflation (CPI-U) for an extended period of time.

Connell believes net rental income from multifamily rental properties will continue, at a minimum, to track inflation in the future. Connell is not aware of any other asset class that can claim a comparable correlation.